“Throughout Africa, KickStart is lifting thousands of families out of poverty by helping them address their greatest need: finding a way to make more money.

In the 1980s, Martin Fisher spent years doing traditional anti-poverty work in Africa, only to see a string of community-development projects flounder and fail. Finally, he had a flash of insight that would prompt him to create a very different kind of nonprofit, KickStart. “I learned a lot of ways not to do development and came to this realization that the poor person’s No. 1 need is a way to make more money,” he said.

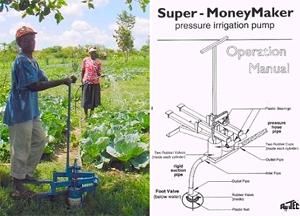

Launched in 1991, KickStart identifies profitable businesses that people can start with a small investment and then creates and sells the tools and equipment that people need to enter those businesses. As a result, more than 130,000 profitable new businesses have been started throughout Africa, more than 65,000 acres of farmland are being irrigated by KickStart pumps, and about 650,000 people have been lifted out of poverty.”

Source: Faith and Ledership.com (good overview article)

Qatar.cmu.edu (long essay with details)

Wired Magazine profiles one of their low cost water pumps that costs between $75 and $160, and have sold over 230,000)

Related: Paul Polak, Making a Dent in the Universe

Another excellent social entrepreneur project is KIVA.org, which operates through local partners in dozens of third world countries around the globe. Basically you loan as little as $25 to an individual or group of individuals who have small businesses, which range from growing crops or livestock to making windows and doors, selling second-hand clothing, selling food in the local market, or door to door etc. One man we loaned $50 used his loan to build sanitary toilet facilities for families in his village that they could pay for on time.

You can choose who you lend to, according to your preferences. I like loaning to women, and to elders who still find it necessary to work in their 60s-70s. Your loan is pooled with that of other lenders to make up the total loan, and after a few months repayments begin, and you can either draw the money out or re-loan it. We have made 64 loans, putting in less than $200 and the money has been repaid and been loaned out again, recirculating enough to make almost $1600 in loans! In five years only one person has failed to repay her loan, and she was a victim of a tsunami that swept her village away.

Many of KIVA’s partners offer access to health and medical services, literacy programs and business education as well as banking services, which are denied to the very poor by the regular banks.

That’s a great plan. Love hearing your story. Thanks for sharing.

From what I’ve read, women have the best track record for repaying loans.