“About a week and a half ago I did a post along with many other of the tiny house bloggers where we conducted a survey of tiny house people. It asked things like income, savings, etc. so we could get a better idea of what a tiny house person is like and how they compare to the typical American.

We had a TON of responses and with such a great response it prompted me to want to do something extra special for you all. So I have put together a Kick Starter campaign to raise the money to fund the creation of a tiny house infographic.

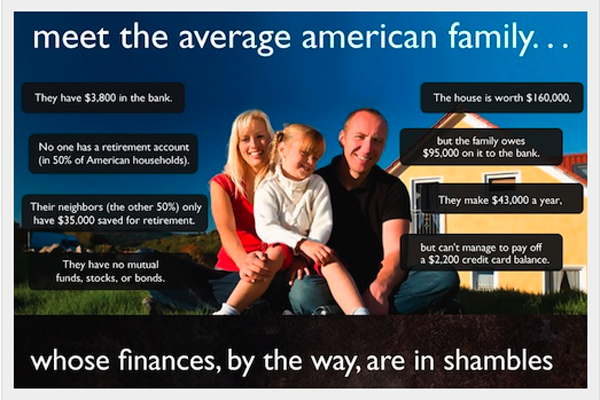

Infographics are a visual way to share data about an interesting topic. Instead of boring graphs and spreadsheets, we are working with a graphic designer to tell the story with color and vivid graphics. You can see an example of this in my first post of the series that talked about what the average American looks like. So please check out the Kick Starter, we hope you will support us in tell the story of tiny house people.”

Source: The Tiny Life.com

Here is some even more recent facts that I just read. Our trade deficit with the EU is now 116 billion. We even have trade deficits with Ireland (25 billion) and Italy (20 billion). Our deficit with S Korea is now 16.6 billion. Japan with who we had a trade deficit of 76 billion is now working to drive down the value of the yen. This will increase their trade surplus with the US.

Even our friendly neighbor Canada has a trade surplus with us of 32 billion.

People wonder why we have no jobs and the economy is still sinking. They only have to look at Congress who continually wants more and more free trade. Most of the money that is spent on foreign goods, should have been spent on goods made here. The latest total (2012) of US trade deficit is now 736 billion dollars.

I think the formula is something like this: Payoffs from special interests (despite what it does to the US economy) = money for reelection campaign plus a few mil ‘pocket money’. Maybe that’s why Congress’s approval rating is around 5%.

It is actually much worse then that.

US debt is currently 23 times larger then it was during Carter.

US debt to GDP ratio is now 103%.

2012 US trade deficit is now more then 500 billion dollars.

Since 1975 the total trade deficit is more then 8 trillion dollars.

Trade deficit with Mexico is over 60 billion and China over 315 billion.

US is losing a half a million jobs to China every year.

In 2010 the US lost 23 manufacturing facilities every day.

Unemployment for those aged under 30 is at 13% and families with a head of household under 30 have a 37% poverty rate.

53% of all American workers are earning less then $30,000.00/year.

60% of the jobs that were lost during the last recession were mid wage. 58% of the new jobs that were created were low wage.

In 1983 the bottom 95% of wage earners had 62 cents of debt for every dollar earned. Today it is $1.48.

Mortgage debt is 5 times higher then it was 20 years ago.

Credit Card debt is 8 times larger then it was 30 years ago.

Americans on food stamps has increased from 17 million in 2000 to 47 million today.

Over a million public school children in the US are homeless.

20.2 million Americans spend more the half their income on housing.

49% of Americans live in a household that receives direct (check) financial assistance from the federal government.

US population is 315 million.

But hey on the bright side, the government tells us we are not in a depression and things are getting better! Lol!

Yeah, the infographic is somewhat rosy when you look at the bigger picture. Here are a few more examples that put things in better context (cited from memory, feel free to verify). About 85% of recent college graduates now live at home with their parents. Youth unemployment is at record high. One of 10 houses in California are being bought by Chinese. The real estate crash wiped out millions of Americans. Homeowners either lost their homes completely, are in limbo because they can’t pay the mortgage and are waiting for the axe to drop, or they’ve lost their equity since real estate prices dropped. Kangaroo courts with crooked judges rubber stamp foreclosures in about two minutes of hearings (almost always siding with big banks even though they can’t produce the title). Many people’s retirement plans have been wiped out or even outright stolen. Taxes keep going up as the value of the dollar keeps dropping (which means it has less purchasing power). The hockey stick graphs we’ve all seen are actually far worse than shown when you factor in how the government has doctored the stats and how many of the new jobs are public sector jobs that don’t contribute much if anything to society. (Misallocation of resources.) But these make-work jobs help win votes, don’t they? And about $370,000 of national debt is owed by each American, which clearly will never get repaid. Maybe that’s why government is eagerly working on gun control, gun confiscation programs and registration schemes?

I thought the average credit card debt was much higher. Accordingly to Nerd Wallet.com, they say individual credit card debt is $7,194 and average household credit card debt is $15,422. That sounds way closer than $2,200.

http://www.nerdwallet.com/blog/credit-card-data/average-credit-card-debt-household/